Retirement Annuity

Retirement annuity is a contract between an individual and their insurance company and should specify an upfront payment that the individual will make to the insurance company in exchange for an upfront payment. The payment is usually monthly, traded as a deal between insurance company and the annuitant.

Each payment made by the annuitant is either deferred or immediate and can be made from a lump sum or can be made as a regular monthly payment from employment. The insurance company makes an assumption that the individual will not outlive the contract.

Individuals decide when they want the payments to start and again how long they will have to have the payments deferred for. The payment is deferred simply because the annuitant has to have sufficient funds to pay the payment in case they stop working for some reason. Insurance companies like to make assumptions that the person’s life span will be long, hence they can defer the payment until some time when the person may outlive the obligation. 카카오 주식

Annuity Payments

The payments made by an annuitant are called annuities; payments from the life insurance policy can be funds or cash lump sum. The lump sum is simply the upfront payment that was paid up front. Before you purchase a policy you need to see what kind of annuity your intend to buy.

The purchase of a life insurance policy involves the payment of an upfront premium, which you have to pay when you purchase the policy. The money is paid to the insurance company in a lump sum, after this is done there are monthly payments coming out of your account that you need to pay.

It is always advisable that before you purchase life insurance you can shop around and find the best deal. Insurance companies like to constantly change their policies because of the needs of their customers. Try not to aim too high, the insurance company can make quite a bit of money on this purchase.

There are two types of annuities, the immediate and the deferred annuity. An immediate annuity means that you will receive payments straightway into your bank account, typically in a year’s time.

The deferred annuity consists of two parts, the first part is an upfront payment and the second part is payments that finally arrive after a delay of one year. Some insurance companies specialize in the deferred annuity so it is a better idea to shop around.

There are various insurance companies and each one has offers that you cannot obtain from any other, always check what you are getting and do not be fooled by big claims. It is better to buy a policy from a big and well-known insurance company to make sure you get the best deal.

In the immediate annuity, payments will continue as long as you live but the payments that will come after the person stops working will be deferred for one year. After this the payment will cease.

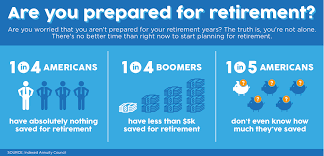

Proper retirement planning and management is incredibly important to individuals of all ages because failure to take these steps will mean that the retirement years will be more difficult and the result of your ReserveBecause the life expectancy of some groups of people is lower than others, it is wise to choose the payments to occur at the age of 65 or 70. Retirement Annuity